It’s no secret that the world of health insurance can be complicated. For something so essential to the average American, the fine print, financial moving targets, and insider language has created an abundance of confusion and misunderstanding. However, understanding health insurance doesn’t have to feel like playing lawn darts in the dark. Like music, video games, or even cooking,

insurance has a lot of moving parts that make sense when they’re all put together. However, like any skill, it all starts with the basics.

What Is Insurance?

Insurance exists to help us financially manage loss, like sickness and injuries. We pay insurance companies a monthly consideration, or premium, to help share the costs of medical care. The more an insurance plan covers, the more risk is being placed on the insurance company, and the higher the monthly premium will be. Before the Affordable Care Act came into full effect in 2014, insurance companies managed risk by increasing premium rates or completely denying applicants with certain pre-existing conditions like diabetes, cancer, and mental illness. The Affordable Care Act forbids companies from raising rates or denying applicants on any pre-existing conditions except for age. While invaluable to Americans with pre-existing conditions this mandate also required companies to take on an egregious amount of risk, which could be destructive to companies and policyholders alike. To offset this heightened amount of risk, The Affordable Care Act created limits on when individuals can enroll in insurance. Anyone can enroll in insurance during the Open Enrollment Period, which runs from November 1st to December 15th every year. While these deadlines are firm, there are exceptions called Special Enrollment Periods (SEP’s).

How Does Insurance Work?

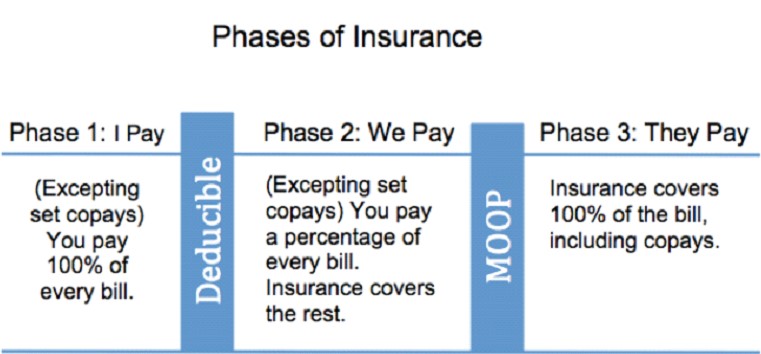

Insurance occurs in three different phases and typically resets at the beginning of each calendar year. These phases are separated by financial benchmarks called a deductible and maximum out-of-pocket cost. Your monthly premium does not contribute to either of these benchmarks.

Phase One typically begins at the start of each calendar year. In this phase, you are responsible for 100% of your medical bills. Phase One ends after you hit your deductible, or the amount of money you have to cumulatively pay for medical care until your insurance coverage kicks in and starts helping you with your costs.

Deductible amounts vary greatly depending on what plan you have. In general, the lower the deductible, the higher the insurance premium will be. A low deductible is generally considered to fall in the range of $500 – $1,000, and a high deductible usually falls between $5,000 – $8,000. Oftentimes insurance will waive the deductible, or pretend you’ve already entered Phase Two, and help pay for medical costs that they know people encounter a lot like going to see your Primary Care Provider. When insurance waives the deductible on something, they typically still expect you to chip in on some of the costs. This cost is typically a flat rate due at the time of service, or a co-pay. Some of the most common services insurance plans waive the deductible on are trips to the doctor’s office, urgent care visits, and mental health/counseling sessions. While commonly covered, not all insurance plans offer the same benefits so be sure to read over a plan carefully before enrolling and ask your broker for help identifying these specific details.

Phase Two of insurance occurs after a person hits their deductible. At this point, you and your insurance share the cost of your medical bills. For services that insurance waives the deductible on, you’ll continue just paying set copays unless your plan specifically states otherwise. For all other medical costs that insurance didn’t help with in Phase One (which is usually things like ER visits, surgeries, hospitalizations, etc), you and insurance will pay together. You’ll be responsible for a predetermined percentage known as coinsurance. Coinsurance rates vary, but insurance will typically pay between 50% and 90% depending on what plan you’re on.

Phase Three of insurance occurs after a person hits their Maximum Out-ofPocket (MOoP). A Maximum Out-of-Pocket is a predetermined maximum amount that you’ll pay for medical care in a given year. After the sum of everything you’ve paid for medical expenses reaches the Maximum Out-Of-Pocket amount insurance will cover 100% of your medical bills, including copays, for the rest of the calendar year. The federal limit on a MOOP amount is $8,150, but many insurance plans set it at much lower rates. Read over your plan options carefully to understand what your Maximum Out-of-Pocket will be. When in doubt, don’t be afraid to reach out for assistance. A local insurance broker can help you understand how your specific needs fit into each plan and can make recommendations based off of your situation and preferences.